About gifts of stocks, securities, and mutual funds

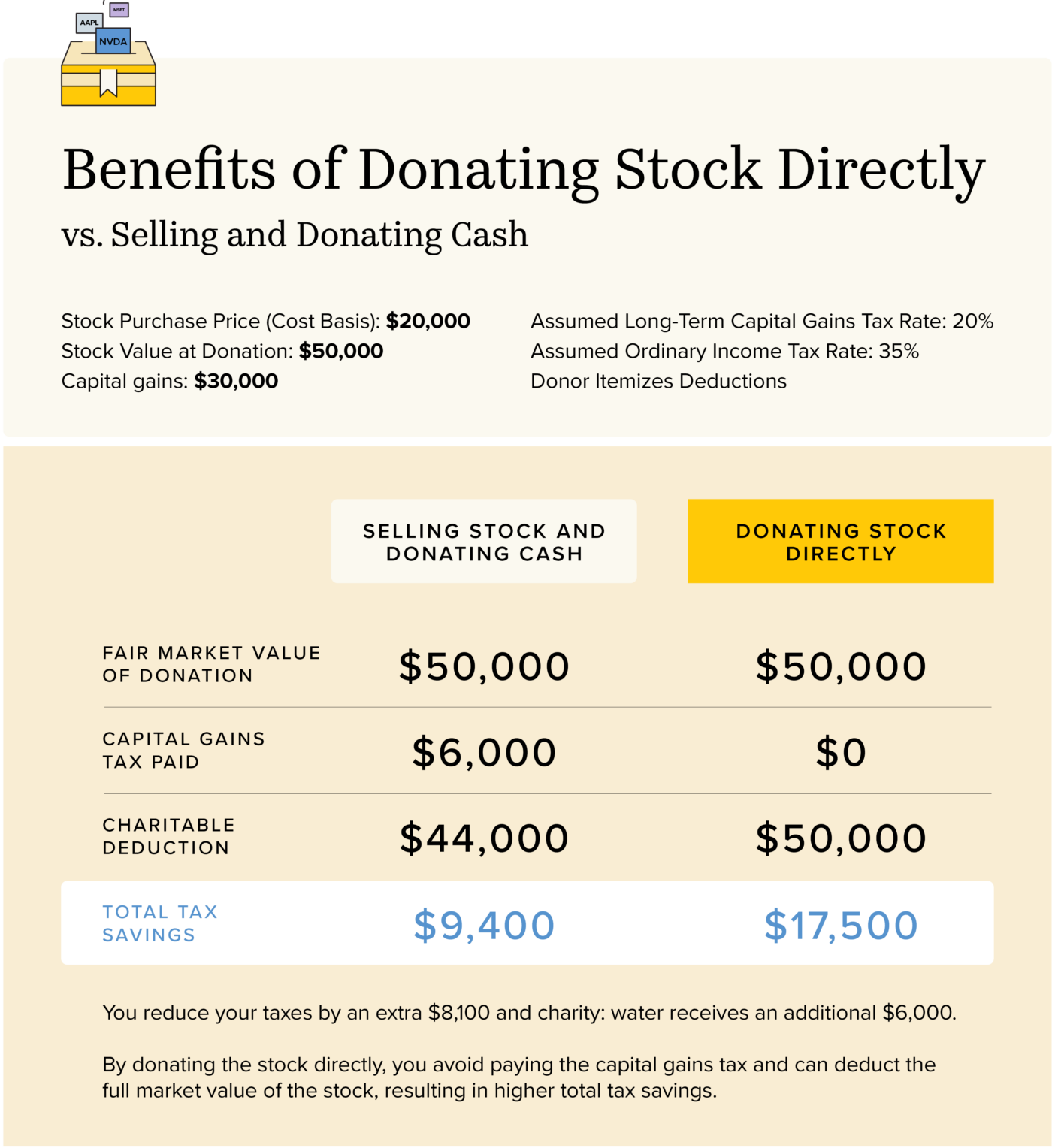

Giving appreciated assets such as stocks, securities, and mutual funds can help you avoid paying capital gains taxes. And if you’ve had the assets for more than one year, you can also receive an income tax deduction.

Give appreciated assets now and enjoy the benefits, or add us as a beneficiary of these assets and eliminate estate and inheritance tax, making the most of your gift.

Benefits

- Gifts of assets can often save you far more on taxes than gifts of cash

- Avoid all capital gains taxes

- Receive an income tax deduction for the value of the assets (if you’ve had them for more than a year)

- Make an immediate impact in ending the water crisis

How it works

- Transfer appreciated securities directly to charity: water (and avoid all capital gains taxes).

- Receive a tax receipt for the value of the assets.

- The securities are sold and the funds are immediately put to use for the greatest impact.

Don’t wait to make an impact, donate stock today

Start my stock donationGet in touch

If you have any questions for our team, we want to provide the best support for you. We’d be happy to speak with you about your giving goals — with no obligation.

Name: Kees (Case) Groenewegen

Title :Associate Director of Key Relationships, Legacy & Asset Giving

Phone: 646-688-2323

Already included us in your estate plan? Let us know.

More ways to make an impact

Gifts in a will or trust

Donations in your will or trust are by far the most popular type of planned gift. We can help you add charity: water into your existing plans or, if you don’t have a will or trust, help you set one up at no cost to you.

Beneficiary designations

Gifting assets not covered by your will — like 401(k)s or IRA accounts — may help your heirs avoid unwanted taxes, even if you’re below the estate tax threshold.

Gifts that pay you back

Give assets while providing yourself or others with income for a period of time or distributions at a later date.